MENA: Edtech's Sleeping Giant

The MENA region is a notable absence of the burgeoning global Edtech space

The global leaders in education technology were all born in the past decade. Coursera was founded in Palo Alto, California in 2012. BYJU’S was founded in Bengaluru, India in 2011. Yuanfudao was founded in Beijing, China in 2012. Ruangguru was founded in Jakarta, Indonesia in 2014. Hotmart was founded in Belo Horizonte, Brazil in 2011. Photomath was founded in Zagreb, Croatia in 2014. Together these companies reach over 750M learners.

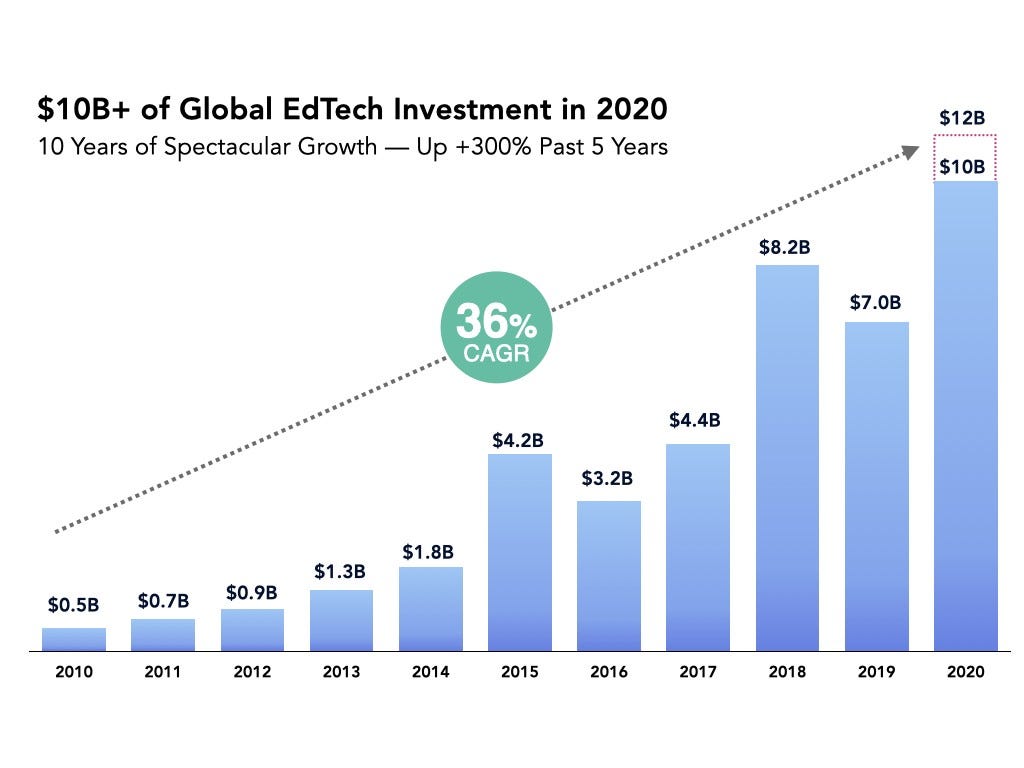

After many false dawns, EdTech seems to be finally having its moment — not the least as a result of the ongoing pandemic. These developments have not gone without notice. Almost $12B of venture funding went into education technology in 2020 and the majority of those funds went to disruptors in China and India.

The global EdTech leaders span practically all the regions of the world, with few exceptions, most notably the MENA (Middle East and North Africa) region. MENA’s exclusion from this list is particularly notable given the region’s budding startup ecosystem and underlying demographics.

In the last several years, several successful tech startups have broken out in the region. Careem, Souq, Mawdoo3, Talabat, and Swvl collectively raised over a billion dollars. They employ thousands of people across the GCC, as well as in Jordan and Egypt. In conjunction with global tech companies, these regional startups have developed a deep pool of entrepreneurial and technical talent. Today this talent is flowing into MENA’s EdTech ecosystem.

MENA’s demographics are ripe for EdTech companies to break out. The population is a pyramid tilted toward youth that will continue to yield a growing number of students: UNESCO estimates that the region has ~100 million school-age students. Egypt alone will add almost 1M new students to its higher education system by the end of 2021. The total addressable market is significantly larger if we factor in the reskilling and upskilling of adult workers needed across MENA as a result of the 4th industrial revolution — particularly relevant in the region where university degrees are often correlated with unemployment.

In parallel, internet and smartphone penetration as well as GDP per capita across MENA affirm that innovations like affordable online learning are viable. Excluding Syria and Yemen, internet penetration in the Arabic speaking Middle East is over 90%. Smartphone penetration in the region is among the highest globally at 97%. Critically, the willingness to adopt tech products is high. Many opinion polls show that MENA youth believe that the internet will play a vital role in their education going forward. These polls are already backed by user adoption and behavior.

While there is no global EdTech player from the region yet, MENA has been experiencing significant growth over the past decade. Across the region’s leading EdTech platforms, user numbers have increased from 500,000 to over 40M registered users today. Global EdTech platforms such as Coursera and Udemy also have over 15M users from the region. This demand is translating into investment activity. According to MAGNiTT, 2020 saw over $20 million in total funding across 5 regional startups.

Most of the funding went to online learning startups. Globally, the coronavirus pandemic has forced 1.6 billion learners online, and MENA is no exception. The region’s largest platforms have seen up to a 4-fold increase in enrollments and the pandemic has encouraged governments to collaborate directly with EdTech startups to support distance learning efforts. In essence, COVID-19 is driving the adoption of online learning and is disrupting the traditional offline model. It is too early to determine the full extent of this once-in-a-generation event on MENA’s EdTech landscape — but the genie is out of the bottle.

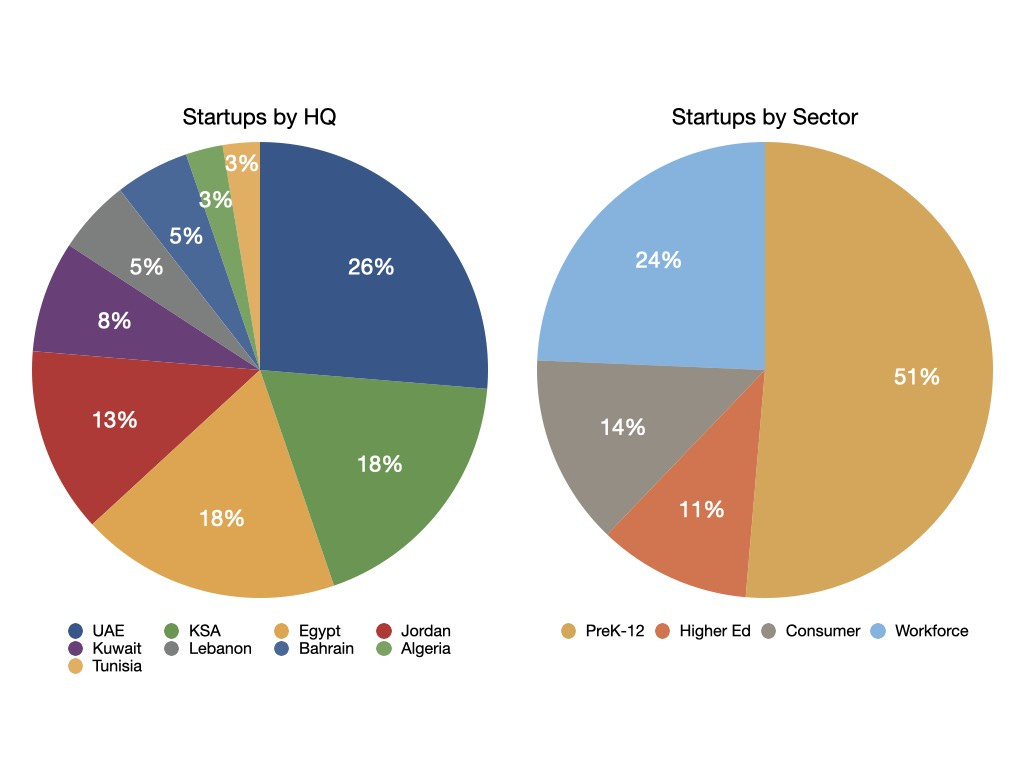

In order to understand this evolution and where the ecosystem stands today, we spoke to nearly 50 leading EdTech startups and investors in the region. These discussions helped us understand where the ecosystem is today and what needs to be solved in order to create global leaders.

The startups we spoke to have a median age of five years, and reach 250K students each on average (ranging from 1K to 17M). Across the board, these startups averaged revenue of ~$1M on $600K of capital raised. Little Thinking Minds is the oldest company at 16 years. Lamsa has the largest reach at 17 million. Noon Academy has raised the most capital at $21.6 million. Notably, no EdTech startup in the region has yet broken $10 million in annual B2C revenue.

MENA’s EdTech companies face several challenges. Three prominent challenges are market fragmentation, digital payments, and exits.

Fragmentation

MENA is a region composed of multiple countries, which often creates its own set of challenges for entrepreneurs taking a regional approach. Despite strong similarities of language, history and culture, countries can vary greatly in key attributes like legislation from Egypt (98 million people) to Bahrain (1.6 million people). Each one of these markets has its own unique set of challenges and opportunities. But moving from one country to another in the Middle East has been done and is becoming easier. From an educational standpoint, each country has its own teaching standards and regulators, but there is significant overlap between these standards and the shift online has made attracting cross border audiences much easier. We see this change with startups like Noon Academy in Saudi Arabia, which started with its local market but now has more of its users in Egypt.

Digital Payments

Parents’ willingness to pay for education is well established and high compared to local purchasing power; however, we have yet to see this demand fully translate online in a B2C model. Importantly, most consumers in MENA are not yet accustomed to paying online. Over 60% of online consumers in MENA still prefer Cash on Delivery (COD), though this mentality is starting to evolve. As such, startups often need to collect payment physically for digital services. For example, in Jordan, online learning platform Abwaab is partnering with delivery services Talabat and Careem NOW to provide scratch cards as a payment method for customers that are not yet ready to pay online.

Exits

Similar to other emerging markets, the startup path to exits is not straightforward in the MENA region. Outside the UAE, MENA still lacks robust and liquid public markets as well as obvious strategic buyers for EdTech companies. Nevertheless, the region has come a long way since Yahoo bought Jordan’s Maktoob in 2009. There were 27 exits and IPOs in 2019 and there have been promising signs over the past 3 years with some prominent exits — if not any major exits yet in the Edtech space. In 2019, Fajr Capital, Blackstone and Mumtalakat sold their stakes in GEMS Education to CVC. Audiobook app Kitab Sawti was acquired by Storytel earlier this year for an undisclosed fee. Tutoring platform, Ostaz (formerly Synkers) was acquired in early 2021, by global private school provider Inspired Education Group.

Of course, outside education, Dubai-based Careem made global headlines in 2019 when it was acquired by Uber for $3.1B, outdoing Souq.com which was sold to Amazon for $580 million in 2017. More recently in 2021, MENA-based Spotify competitor, Anghami made headlines by going public on the US Nasdaq via a SPAC at a valuation of $220 million.

There are still many challenges to be overcome for MENA Edtech. Nevertheless, the demographics and emerging talent in MENA portend a promising future for the region, its learners, its entrepreneurs, and its backers. Watch this space: MENA is Edtech’s Sleeping Giant!

This post was co-authored with Mujtaba Wani, an investor at GSV Ventures. The first version of this post appeared on his page here.